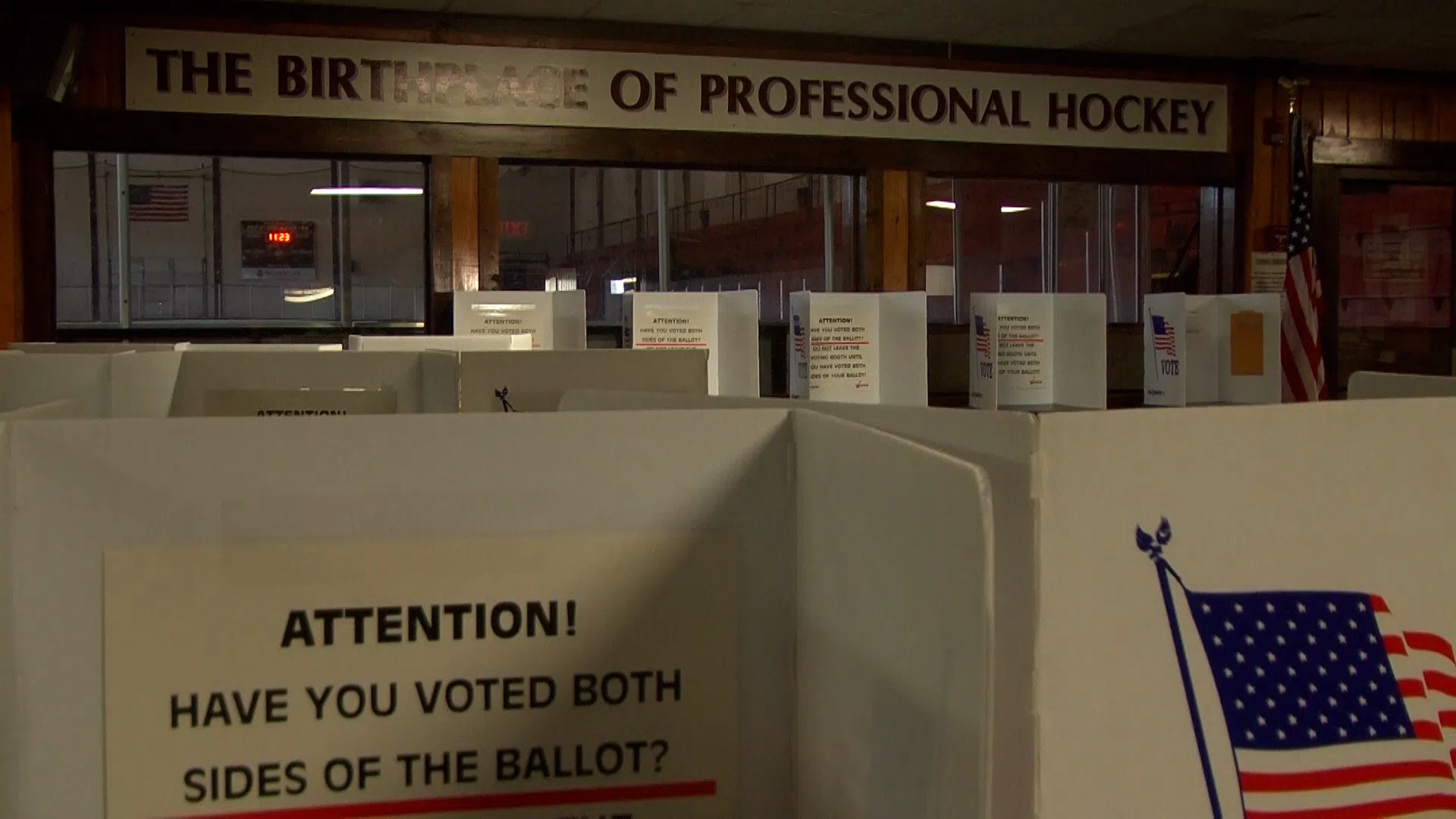

Houghton Portage Township Schools approves ballot language for the district’s non-homestead operating renewal.

In November City of Houghton and Portage Township voters will return to the ballot box to consider a 17.1103 mill renewal for the HPTS non-homestead operating millage. The non-homestead millage is applied to businesses, second homes, vacation homes, rental properties, and vacant land within a school district’s boundaries. The Houghton Portage Township Schools renewal request falls below the 18 mills limit allowed by state law.

School district superintendent Anders Hill says renewing the non-homestead millage rate will not increase taxes on a primary residence and is necessary for school district to fully fund educational program, and operational costs. Taxes collected by the non-homestead millage rate account for between 12 and 15 percent of the HPTS operating budget.

Find a full statement from the school district below.

********************************************************************************

HOUGHTON, MI — The Houghton-Portage Township Schools Board of Education has approved a non-homestead operating millage question that will appear on the ballot Tuesday, November 4, 2025.

If a majority of voters approve the measure, the levy would continue to be applied to businesses, second homes, vacation homes, rental properties, and vacant land within the school district. The district is asking voters to consider renewing the levy at the existing rate of 17.1103 mills, which is below the 18 mills limit allowed by state law and levied by most schools in Michigan.

One mill represents $1 per $1,000 of property value.

“A renewed non-homestead millage would not increase property taxes and is not a tax on primary residence,” said Superintendent Anders Hill. “This levy is common throughout Michigan, and all schools are required to have this approved by voters since Proposal A in 1994. It is necessary for school districts to be fully funded, which ensures our students have the resources and educational environment they need to be successful.”

Money generated by the non-homestead millage has accounted for 12-15% of the district’s operating budget in previous years. The funds support essential day-to-day expenses that include classroom supplies, utilities, food service, transportation, staff salaries and benefits, and building maintenance.

Should the non-homestead millage on the November ballot not be renewed, the district would need to consider budget cuts. This could include increasing class sizes, reducing staff, and eliminating academic programs or extracurricular activities.

“Our district is known for providing an exceptional education and remains a top-tier district for families in our region,” Hill said. “This operating millage is a key source of financial support that makes it possible for that to continue.”

Operating millages differ from voter-approved general obligation bonds that fund large-scale capital improvement projects, such as construction or extensive renovations.

More information, including answers to frequently asked questions, is available online at https://www.hptsoperatingmillage.org.

Comments