What a difference a year makes for the oil market, and that could have a profound impact on your wallet this summer. Last spring, the economic shutdowns in response to COVID-19 caused dislocations in several markets. Toilet paper was running low because it normally supplies commercial businesses and office buildings, in addition to homes. All of a sudden, two of those supply chains had no need for the product, and residential demand was through the roof. Milk had to be dumped on the side of the road since school closings eliminated a major customer.

For oil and gas, it created a market scenario known as supercontango. That occurs when the price in future months is dramatically higher than the spot price, what it costs today. The April 2020 oil contract closed at -42 dollars per barrel. They were paying people to take the product of their hands because no one was travelling. That created an incentive to hoard Texas tea in every storage unit and tanker one could find, which meant there was a ton of supply hitting the market for the rest of the year.

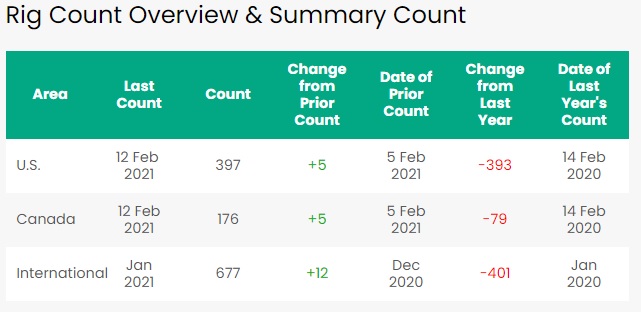

That caused oil production to crater. The most recent Baker Hughes rig count shows the number of wells drilling for oil and natural gas has been cut in half in the past year in the country. The Biden Administration’s decision to end the Keystone XL Pipeline and halt drilling on federal lands is adding to the supply constraints as America prepares to get back to business post-vaccine.

Before 2014’s oil bust, the Baker Hughes rig count was routinely over 1,000. Sometimes it ran towards 1,500 or 1,600. Today’s levels are some of the lowest since the George W. Bush administration.

A recent shutdown of most of America’s refining capacity across the Deep South due to unusually cold winter conditions has pushed futures markets into an equally rare scenario known as backwardation. That occurs when the spot price is above the price of oil for future months. It normally happens when there is Middle East turmoil. Why is that strange? Think of all the costs and unknowns associated with buying oil to be delivered in August, six months from now. You either need to purchase it at today’s price and store it, paying for that service for a half year or you need to commit to doing so down the line. There’s uncertainty attached to that. You don’t know what is going to happen between now and then. Usually, market participants charge a premium for that.

Backwardation essentially tells everyone in the oil and gas space to get as much product to the market as possible today as they can. That means supplies will be tight later on when demand is much higher. Markets tend to front run the summer driving season, with prices peaking in May in anticipation of the high usage as people pack the kids into the car and drive to vacation spots hours away. With supply constraints facing the market today, a relatively quiet time of the year, it is hard to imagine those will alleviate into June and July. Capacity can’t come back online that quickly, especially when Washington, D.C. is hostile to it.

Keweenaw Report Your Source for Local News and Sports

Keweenaw Report Your Source for Local News and Sports