Rukkila Negro Accounting’s Christina Smigowski presented the firm’s review of Hancock’s financial statements for Fiscal Year 2020 at Wednesday’s council meeting. Overall, the city was given a passing grade, with one red flag noted. City expenses persistently came in above what was budgeted and that required the council to approve a Corrective Action Plan that will be submitted to Michigan’s Department of Treasury.

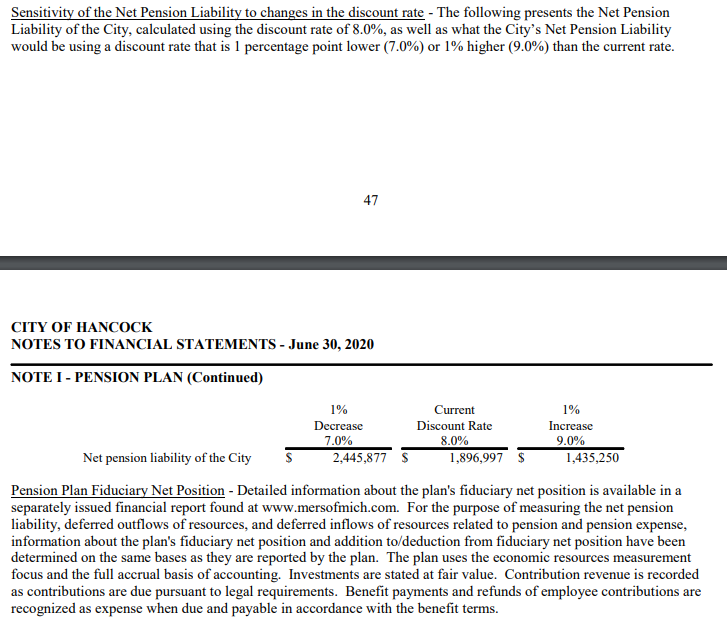

Mayor Paul LaBine asked immediately about the city’s pension liabilities. Assuming an eight percent rate of return on investments, Hancock will be required to pay in nearly $2 million in the coming decades. If investment returns drop to seven percent per year, that figure is over $2.4 million. With bonds yielding near-record low rates and a target allocation of 60 percent in equities, the lower figure could easily come to pass.

Councilman John Haeussler noted that it has become common practice for the city to pay in more than is required.

Future obligations will be limited by increased funding from newly hired employees. At one time, they were required to pay in 3.3% of their salary. It is now 5%, but the defined benefit plan remains more generous than what is found in a typical IRA.

The council agreed to engage with Robert W. Baird to potentially refinance roughly a half million dollars of debt, including 2008 building fund bonds that were used to renovate city hall. The current interest rate is 4.25-4.5%. City Manager Mary Babcock says Baird will only be paid a placement fee if terms are agreed to with a third-party. She says representatives from Baird expect that banks will snap up the debt directly, rather than seeking public investment. The savings could be quite significant.

Public comment was given by Chris Woodry on the potential development near Coles Creek in the City of Houghton.

Keweenaw Report Your Source for Local News and Sports

Keweenaw Report Your Source for Local News and Sports